E-commerce in the UAE is booming in 2025, and businesses are working harder than ever to offer a seamless and secure online shopping experience.

With more people choosing to shop from the comfort of their homes, having the right payment gateway is no longer just an option—it’s a necessity.

Think about it: when customers are ready to buy, they want a smooth, hassle-free checkout process.

If payments are slow or complicated, they might just abandon their cart and never return.

That’s why choosing a reliable payment gateway is crucial—it ensures transactions are safe, quick, and effortless for both you and your customers.

Whether you’re launching a new online store or scaling up your existing one, understanding the best payment options available in the UAE will help you stay ahead of the competition.

After all, the easier you make it for customers to pay, the more likely they are to complete their purchase and come back for more!

What is a Payment Gateway?

A payment gateway is like a digital bridge that connects your bank account to your online store, making it easy for customers to pay you.

Think of it as a secure tunnel that ensures money moves safely from their account to yours.

Gone are the days when payments were limited to just cash or bank transfers.

Now, shoppers can pay with their debit or credit cards, UPI, online wallets, net banking, and more—giving them the flexibility to choose what works best for them.

These gateways aren’t just offered by banks; many specialized financial companies provide them too, each with unique features designed to make online transactions smooth and secure.

So, whether you’re setting up a new store or upgrading your payment options, choosing the right gateway can make a world of difference for your business!

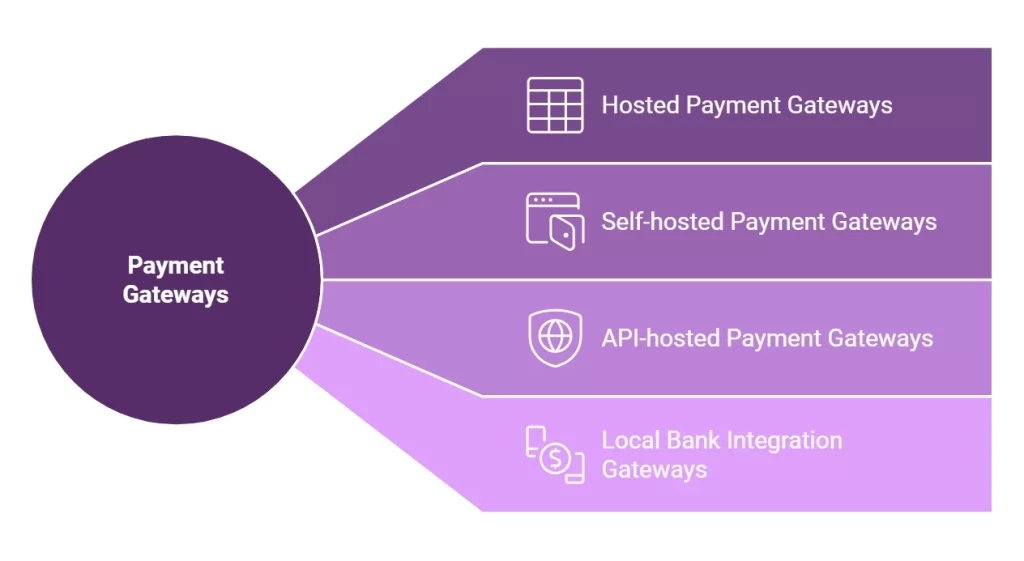

Types of Payment Gateways

Payment gateways are essential tools in today’s digital economy, enabling online transactions and electronic payments.

There are several types of payment gateways.

Let’s explore the main types:

1. Hosted Payment Gateways: Simple, Secure, and Hassle-Free

If you’re looking for an easy and secure way to accept online payments, hosted payment gateways might be just what you need.

They’re popular for a reason—they handle all the heavy lifting when it comes to security, making sure every transaction is safe and PCI-compliant.

So, how do they work?

Instead of processing payments on your own website, hosted gateways redirect customers to a trusted third-party payment page.

This means you don’t have to worry about storing sensitive financial information or dealing with complex security protocols—the gateway provider takes care of everything!

Another big plus?

Hosted gateways support multiple payment methods, from major credit and debit cards to digital wallets like PayPal and Amazon Pay.

That means you can cater to a global audience and give customers the flexibility they expect.

Integration is also a breeze!

Most hosted gateways come with ready-to-use plugins and APIs, making it super easy to connect them to your website or shopping cart.

No complicated setup—just a smooth, secure, and hassle-free checkout experience for both you and your customers.

In the fast-moving world of e-commerce, security and convenience are everything.

With a hosted payment gateway, you get the best of both!

2. Self-hosted Payment Gateways: Full Control, Maximum Customization

If you want complete control over your online payment process, a self-hosted payment gateway might be the perfect fit.

Unlike hosted gateways that redirect customers to a third-party payment page, self-hosted solutions let you collect and encrypt payment details directly on your website.

This means your customers stay on your site from start to finish, creating a seamless and branded checkout experience.

One of the biggest perks?

Customization.

You can design the payment flow to match your brand, add personalized checkout features, and optimize the experience to suit your business needs.

This is especially useful for larger businesses or those with unique checkout requirements.

But with great control comes great responsibility!

Since payment data is handled on your platform, you’ll need to ensure PCI compliance, invest in strong security measures, and stay on top of updates to keep transactions safe and smooth.

If you have the technical expertise or a dedicated team to manage these aspects, a self-hosted gateway can give you the flexibility and security needed to build a top-notch e-commerce experience.

3. API-hosted Payment Gateways: The Best of Both Worlds

If you’re looking for a payment solution that balances customization and security, API-hosted payment gateways might be the way to go.

They offer more control than hosted gateways while still leveraging the security expertise of a trusted provider—giving you the flexibility to create a seamless payment experience without the hassle of handling sensitive data directly.

With an API-hosted gateway, businesses can integrate payments directly into their websites or apps, ensuring a smooth and branded checkout process.

No redirects, no disruptions—just a clean, user-friendly experience that keeps customers engaged.

Of course, there’s a bit of a catch:

API-hosted gateways require some technical know-how.

You’ll need developers to handle integration, updates, and security compliance.

But if your business values both customization and top-tier security, this type of gateway offers the perfect mix of flexibility and reliability—helping you stay ahead in the fast-paced world of e-commerce.

4. Local bank Integration Gateways: A Simple and Cost-Effective Payment Solution

If you’re looking for a straightforward and budget-friendly way to accept online payments, local bank integration gateways could be a great option.

Unlike other payment gateways that rely on third-party intermediaries, this type of gateway connects your business directly to your bank—meaning fewer middlemen and lower transaction costs.

One of the biggest advantages?

Affordability!

Many banks offer lower transaction fees compared to third-party providers, and some even allow businesses to negotiate better rates—especially if you process a high volume of transactions.

That means more savings for your business in the long run.

However, there’s a trade-off.

Local bank integration gateways may not have all the advanced features that larger payment platforms offer, like multiple payment options or global coverage.

They’re typically best suited for businesses that serve a local customer base and want a simple, regionally tailored payment solution.

If your priority is keeping costs low while maintaining a direct relationship with your bank, a local bank integration gateway could be just what you need!

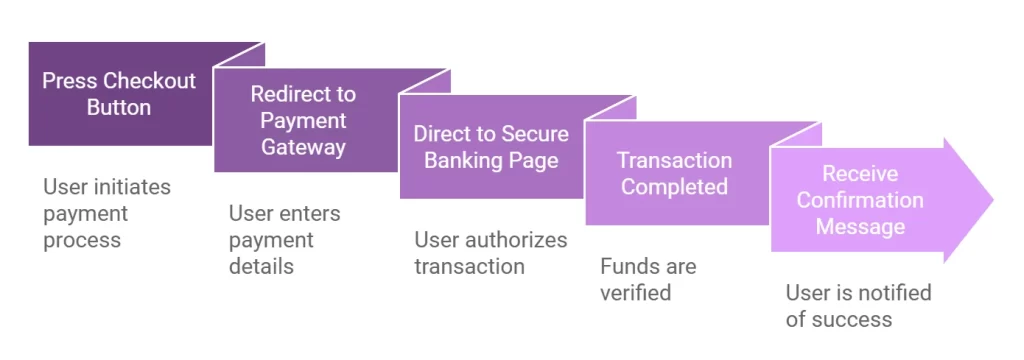

How a Payment Gateway Works: A Quick Walkthrough

Ever wondered what happens behind the scenes when you make an online payment?

Here’s a simple breakdown of the process:

1️⃣ Checkout Begins – You’ve added everything to your cart, and now it’s time to pay. Once you hit the checkout button, you’re redirected to the payment gateway, where you enter your card details or choose your preferred payment method.

2️⃣ Secure Authorization – To ensure security, you’re taken to a secure banking page to authorize the payment. This usually involves entering a one-time password (OTP) sent to your phone or email.

3️⃣ Transaction Processing – The payment gateway quickly checks if you have enough funds and if everything looks good, the transaction gets approved.

4️⃣ Confirmation & Order Placement – Success! You’ll receive a confirmation message, and your order is officially placed. Now, all that’s left is to sit back and wait for your purchase to arrive!

Behind the scenes, the payment gateway ensures that your transaction is secure and smooth—connecting your bank with the merchant while keeping your financial information safe.

Pretty cool, right? 🚀

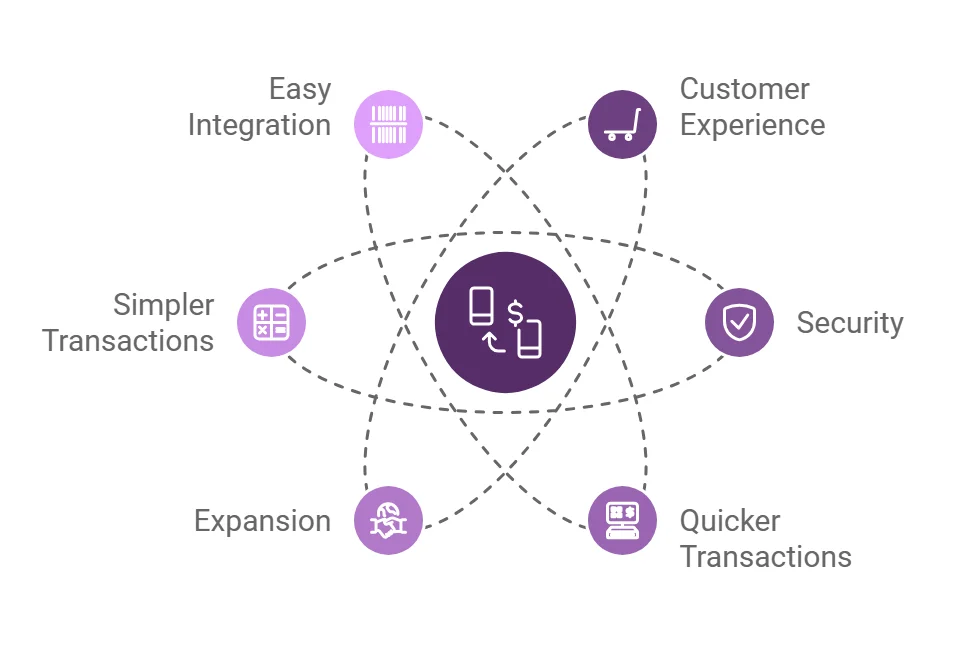

Benefits of Using Payment Gateways

Using a payment gateway isn’t just about processing transactions—it’s about making online shopping easier, faster, and more secure for both businesses and customers.

Here’s why they’re essential:

✅ Better Customer Experience – A smooth and hassle-free checkout process keeps shoppers happy. Payment gateways support multiple payment methods, so whether your customers prefer credit cards, digital wallets, or bank transfers, they have the flexibility to choose what works best for them.

🔒 Top-Notch Security – Trust is everything in online shopping. Payment gateways use advanced encryption and fraud prevention tools to protect sensitive financial data. This ensures a safe transaction environment, helping businesses build credibility.

⚡ Faster Transactions – No one likes waiting! Payment gateways process payments in real time, meaning fewer delays and faster order fulfillment. This is a game-changer for e-commerce businesses aiming to provide quick and efficient service.

🌍 Expand Your Business Globally – Want to reach customers beyond the UAE? A good payment gateway lets you accept international payments, opening up opportunities to scale your business and tap into new markets.

📊 Easier Financial Management – Keeping track of transactions is effortless with auto-generated reports. Businesses can monitor payments, analyze trends, and make smarter financial decisions without the headache of manual record-keeping.

🔗 Seamless Integration – The best part? Most payment gateways integrate smoothly with your existing website or e-commerce platform, requiring minimal setup effort. No special deployment or complicated processes—just plug and play!

16 Best Payment Gateways for Your E-commerce Website in 2025

There are many payment gateway solutions out there, and choosing the right one for your business can be challenging.

To make it easier, we have analyzed and listed the 16 best payment gateways in the UAE, along with their pros, cons, and everything else you need to know.

1. Telr

Previously known as Innovative Payments, Telr is a well-established payment gateway in the UAE with a strong presence in Dubai and Singapore.

Designed for businesses in developing countries, Telr operates in 120+ countries, making it a great choice for merchants looking for global reach.

Getting Started with Telr

Opening a Telr account is simple—just visit their website, and you’re good to go.

The best part?

There’s no setup fee, so you can start accepting payments without upfront costs.

Supported Platforms

Telr integrates smoothly with popular e-commerce platforms like:

✅ WooCommerce

✅ OpenCart

✅ PrestaShop

✅ Shopify

✅ Magento

Payment Options

Customers can make payments using:

💳 Visa, MasterCard, American Express

🏦 Net Banking (Indian banks)

🏦 SADAD (Saudi Arabian banks)

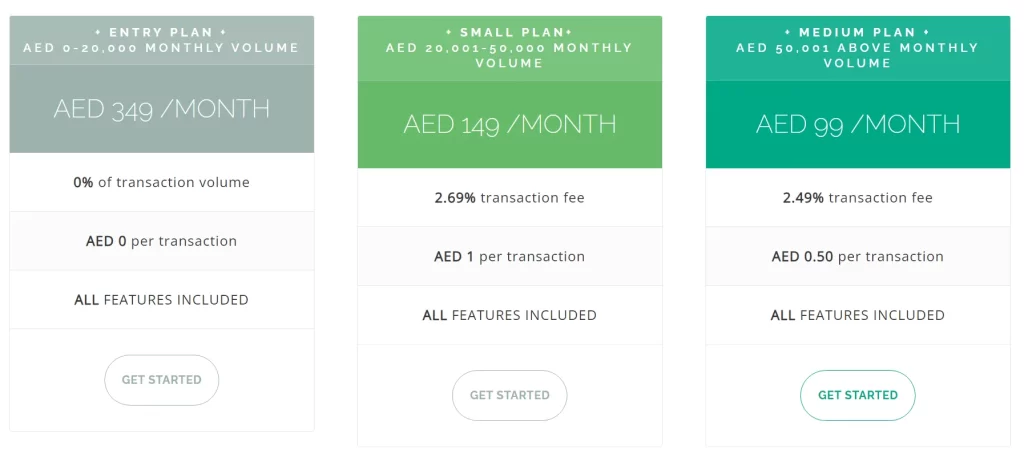

📌 Pricing Plans

Monthly cost | Transaction cost |

|---|---|

AED 349 (entry plan) | N/A |

AED 149 (small plan) | Small Level – 2.69% + AED 1.00 |

AED 99 (medium plan) | Medium Level – 2.49% + AED 0.5 |

🔗 Integration Options

Telr gives businesses three ways to integrate the payment gateway into their website:

1️⃣ Hosted Payment Gateway – Telr hosts a fully responsive payment page optimized for all devices. Once the transaction is complete, customers are redirected back to your website.

2️⃣ iFrame Integration – Embed the payment form within your website using iFrame and customize its appearance with your own CSS.

3️⃣ Fully Integrated Payment Form – Want total control over the payment experience? You can integrate the form directly into your website for a seamless checkout process. However, this requires PCI DSS Certification for security compliance.

Why Choose Telr?

✅ No setup fees

✅ Supports multiple payment methods

✅ Works with major e-commerce platforms

✅ Flexible integration options

Whether you’re a small business or a growing enterprise, Telr provides a secure and scalable solution to handle online payments effortlessly.

2. CashU

CashU has been a pioneer in online payment solutions across the Middle East, originally designed to serve customers in the UAE.

Over the years, it has expanded its reach and is now a popular payment option in Europe as well.

Known for its robust security measures and advanced fraud prevention systems (AML), CashU ensures that every transaction is secure and free from chargeback risks, making it a reliable choice for businesses and consumers alike.

💳 Fees & Charges

Unlike many other payment gateways, CashU comes with some initial setup costs:

🔹 Setup Fee & Security Deposit – Required to implement CashU

🔹 Annual Fee – Varies based on sales volume

🔹 Maintenance Charge – Only $1 per year (one of the lowest in the market!)

✅ Supported Platforms

CashU provides support for MasterCard through its virtual credit card service, making it easy for users to transact securely online.

🔗 Integration Options

CashU offers flexible integration methods to suit different business needs:

1️⃣ Standard Integration – Payment details are sent directly to the CashU server for processing.

2️⃣ Premier Integration – Transactions are authenticated via the CashU web service, where a unique code is generated and used to complete the payment.

3️⃣ API Integration – Businesses can integrate payments using HTTP/REST library or one of Checkout’s SDKs for a seamless experience.

Why Choose CashU?

✅ Advanced fraud prevention & AML security

✅ No chargeback risk for transactions

✅ Affordable $1/year maintenance charge

✅ Multiple integration options for flexibility

If you’re looking for a secure, affordable, and globally recognized payment gateway, CashU is a great option to consider!

3. Checkout

Checkout is a widely used international payment gateway known for its smooth transactions and customizable solutions.

It’s a favorite among businesses in the UAE, offering valuable market insights and adapting to specific business needs.

Originally from the UK, Checkout has gained popularity thanks to its exceptional user experience, secure payment integration, and hassle-free setup.

🌍 Why Businesses Love Checkout?

✅ Seamless transactions with a smooth checkout experience

✅ Customizable solutions to match different market needs

✅ Secure and verified payment integrations

✅ Quick and easy setup for businesses of all sizes

Pricing Structures

🛒 Supported Platforms

Checkout seamlessly integrates with some of the most popular eCommerce platforms, including:

✔ WooCommerce

✔ Shopify

✔ Magento

✔ PrestaShop

🔗 Integration Options

Checkout provides multiple ways to integrate, ensuring flexibility for businesses:

1️⃣ iFrame Method – Embed a payment form directly on your website, with transactions securely processed through token exchange.

2️⃣ Checkout.js – A lightweight widget placed on the checkout page, allowing smooth payment processing.

3️⃣ API Integration – For businesses that need complete control, integration is possible via HTTP/REST library or Checkout’s SDKs.

Is Checkout the Right Payment Gateway for You?

If you’re looking for a secure, reliable, and globally recognized payment solution with easy integration and a great user experience, Checkout is an excellent choice for businesses in the UAE and beyond. 🚀

4. 2Checkout

If you’re looking for a universal payment gateway that lets you accept payments from anywhere in the world, 2Checkout is a fantastic choice.

With support for 196 countries, 8 payment channels, 15 languages, and 87 currencies, it’s built to cater to businesses of all sizes.

💡 Bonus

2Checkout integrates with FreshBooks accounting software, making it even easier for small businesses to manage finances.

💰 No Setup or Monthly Fees

One of the biggest advantages? Zero setup or maintenance fees! You only pay when you make a sale.

📌 Pricing Plans

💳 2SELL – 3.5% + $0.35 per successful sale

🔄 2SUBSCRIBE – 4.5% + $0.45 per successful sale (for subscription-based businesses)

🛒 2MONETIZE – 6.0% + $0.60 per successful sale (for digital goods & global sales)

🛍 Supported Platforms

2Checkout works with almost every eCommerce platform, making it incredibly versatile.

💵 Payment Options

✔ Visa

✔ MasterCard

✔ Bank Transfer

✔ PayPal

✔ American Express

✔ Apple Pay

🔗 Easy Integration Options

1️⃣ API Integration – Secure and PCI DSS compliant for a smooth checkout experience.

2️⃣ iFrame Method – Embed a payment form directly into your site for a seamless user experience.

🚀 Why Choose 2Checkout?

With global reach, no setup fees, and multiple payment options, 2Checkout is a smart choice for businesses looking to expand their online presence and offer flexible payment solutions to customers worldwide.

5. CCAvenue

Looking for a reliable and feature-rich payment gateway?

CCAvenue is a popular choice in the UAE, especially for businesses that need secure and seamless online transactions.

Originally based in India, this gateway has become a go-to option for businesses of all sizes—small, medium, and large.

📌 Why Choose CCAvenue?

✅ Flexible pricing plans that cater to different business needs

✅ Zero setup fee – Get started without upfront costs

✅ 24×7 on-call support – Always available to assist you

✅ Advanced fraud prevention – Keep transactions safe and secure

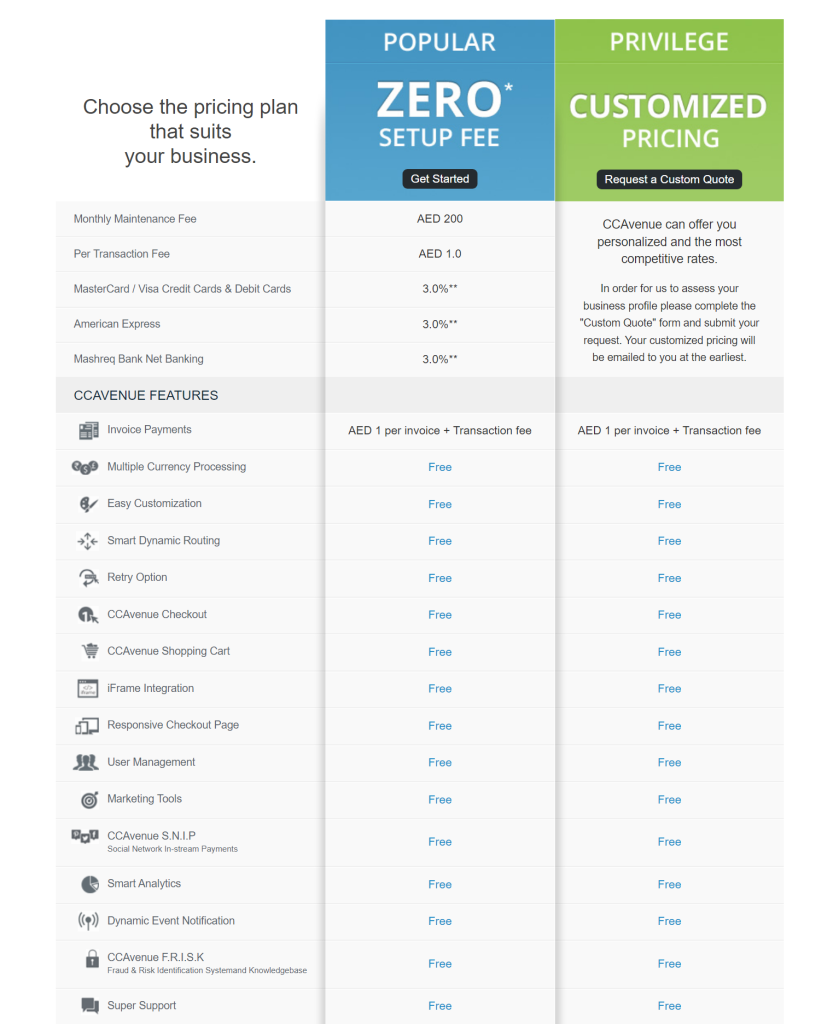

💰 Pricing Details

🆓 Zero setup fee

📅 Monthly maintenance fee: AED 200

While the fees may be slightly higher than some competitors, businesses love CCAvenue for its top-notch security, reliability, and round-the-clock customer support.

🛍 Supported Platforms

✔ Works with all major e-commerce platforms

🔗 Integration Options

💻 CCAvenue Billing Page – Use a customized checkout page without worrying about development and maintenance.

🖼 iFrame Checkout – A preconfigured payment form that blends seamlessly into your website.

🚀 Direct Payment Integration – Keep users on your website with a fully embedded secure payment solution.

With CCAvenue, you get a robust, scalable, and easy-to-integrate payment gateway—ideal for businesses looking to provide a smooth checkout experience. 🚀

6. Cybersource

Looking for a reliable and secure way to accept payments online?

CyberSource, a Visa-owned payment gateway, makes transactions easy and fraud-free in 190+ countries.

Whether you’re running a small online store or a large enterprise, CyberSource provides seamless payment processing, strong security, and flexible integration options to keep your business moving forward.

🌍 Why Choose CyberSource?

✅ Backed by Visa – Industry-leading security and compliance

✅ Supports digital wallets – Apple Pay, Google Pay, Samsung Pay, Alipay & more

✅ Advanced fraud prevention – AI-driven fraud detection to keep transactions safe

✅ Global reach – Accept payments worldwide with ease

🛡 Powerful Features

🔄 Cross-Channel Payments – Accept payments via mobile, web, and in-store

🚨 Fraud Alert – AI-powered fraud detection to reduce risks

🏠 Delivery Address Verification – Validate addresses for secure shipping

🆔 Account Takeover Protection – Prevent unauthorized access to customer accounts

🔗 Integration Options

💻 API Integration – Seamlessly integrate with Apple Pay, Google Pay, Samsung Pay, Chase Pay, and Visa Click to Pay

With CyberSource, you get a secure, scalable, and globally recognized payment gateway—perfect for businesses looking for trust and efficiency in their transactions. 🚀

7. Amazon Payment Services

Formerly known as Payfort, Amazon Payment Services is now one of the most reliable and widely used payment gateways in the UAE.

Since Amazon acquired Payfort in Q4 2020, the platform has gained even more trust and security, ensuring smooth transactions while minimizing risks.

💡 Why Choose Amazon Payment Services?

✅ Backed by Amazon – Unmatched reliability and security

✅ Designed for the Arab market – Tailored for local shopping habits and trends

✅ Perfect for startups – A popular choice among new entrepreneurs in the UAE

✅ Risk-free transactions – Reduces fraud and ensures safe payments

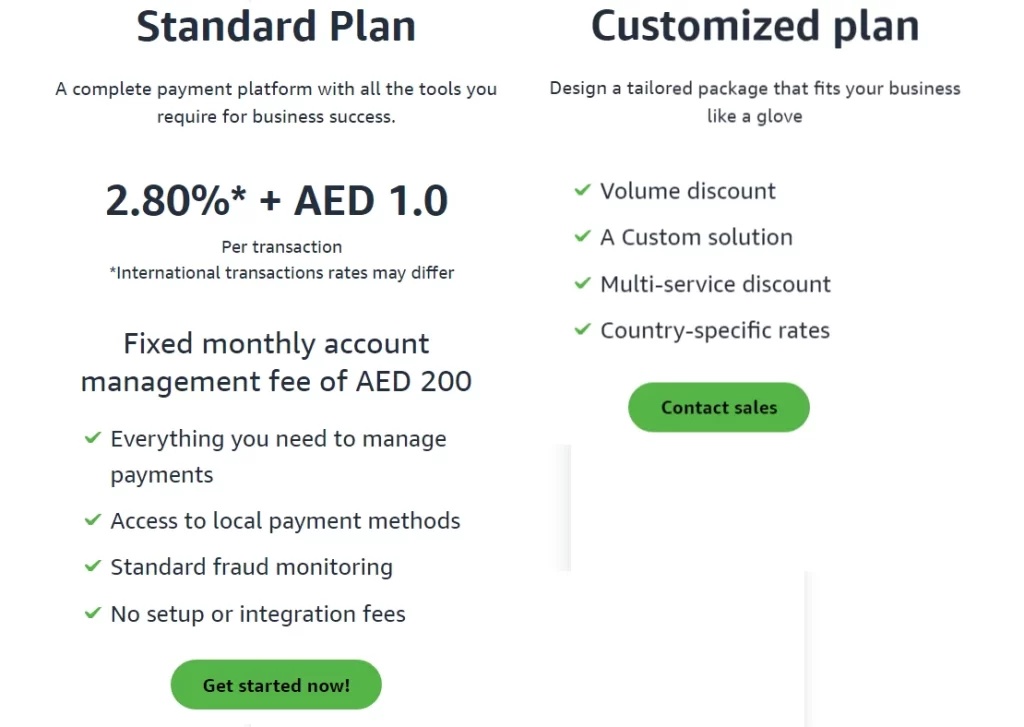

💰 Pricing Structure

📦 Standard Plan

💳 Monthly Fee: AED 200

💰 Cost Per Transaction: 2.80% + AED 1.0

| Plan | Monthly Fee | Cost Per Transaction |

|---|---|---|

| Standard Plan | AED 200 | 2.80% + AED 1.0 |

8. PayTabs

Since its launch in 2014, PayTabs has built a reputation for its top-notch fraud prevention technology and cutting-edge features.

If you’re looking for a modern, secure, and easy-to-integrate payment solution, PayTabs is a perfect choice.

Setting up PayTabs is quick and hassle-free—you can have it up and running in less than 24 hours!

Plus, it comes with a powerful invoicing system that helps businesses generate and send invoices seamlessly.

💡 Why Choose PayTabs?

✅ Fast Setup – Get started in less than a day

✅ Advanced Security – Strong fraud prevention measures

✅ Seamless Integration – Works with top e-commerce platforms

✅ Smart Invoicing – Generate and send invoices effortlessly

🔗 Supported Platforms

🛒 Magento

🏬 Shopify

🔧 OpenCart

🌍 PrestaShop

🛒 WooCommerce

🏪 CS-Cart

💳 Payment Options

💳 Visa

💳 MasterCard

💳 American Express

🏦 Mada

📲 STCPay

⚙️ Integration Methods

🔹 Hosted Payment – Choose a payment form that fits your website

🔹 E-commerce Plugins – Shopify, WooCommerce, CS-Cart, Magento, OpenCart, and more

🔹 Direct API – Hosted Payment Page, Managed Form, or Merchant’s Own Form

With PayTabs, businesses can enjoy secure, smooth, and efficient transactions—giving customers a seamless checkout experience every time! 🚀

9. Paycaps

Looking for a powerful and customizable payment gateway?

Paycaps is a top choice for apps and e-commerce websites across Dubai, Abu Dhabi, and the UAE.

New businesses love Paycaps for its API-driven automation, making payments smooth and hassle-free.

Plus, it offers a fast, user-friendly interface designed to enhance the checkout experience.

What sets Paycaps apart?

It provides a white-label solution, allowing businesses to fully customize designs, payment methods, and themes to match their brand identity.

💡 Why Choose Paycaps?

✅ Seamless API Integration – Automate payments effortlessly

✅ Customizable Interface – Design your checkout experience

✅ Fast & Secure – Enjoy a smooth payment process

✅ Multi-Currency Support – Accept payments globally

✅ Smart Chargeback Management – Reduce risks & ensure safety

🔥 Key Features

💱 Multi-Currency Support – Accept international payments easily

🔄 Chargeback Management – Secure transactions & reduce disputes

🚀 Smart Routing – Optimize transactions & handle rebates efficiently

⚙️ Integration Options

🔹 API Integration – Easily integrate REST APIs for smooth transactions

With Paycaps, businesses get a secure, customizable, and high-performing payment gateway—helping you scale faster and smarter! 🚀

10. Hyperpay

Looking for a secure and efficient payment solution?

Hyperpay is making waves across the MENA region, offering fast, reliable, and seamless transactions.

Based in Saudi Arabia, Hyperpay partners with 100+ banks and leading credit card companies in the UAE.

Whether you’re running an e-commerce store or a subscription service, Hyperpay is built to scale with your business.

💡 Why Choose Hyperpay?

✅ Fast & Secure Transactions – Trusted by thousands of merchants

✅ Seamless E-Commerce Integration – Works with WordPress, Magento & more

✅ Advanced Fraud Protection – Keep your business and customers safe

✅ Customizable Checkout – Tailor the payment experience to your brand

✅ Powerful Dashboard – Get real-time insights into your transactions

🔥 Key Features

💳 High Acceptance Rates – Maximize successful transactions

🎨 Customizable Checkout – Create a seamless payment experience

📊 Smart Analytics Dashboard – Track performance & optimize payments

💰 Available Payment Options

🟢 Visa

🔵 MasterCard

🟠 American Express

🟣 Mada

🔴 STCPay

🍏 Apple Pay

💲 PayPal

⚙️ Integration Options

🖥 COPYandPay – A secure payment widget for quick transactions

💸 HyperSplits – A smart payout system for businesses

📑 HyperBill – An invoicing system for effortless billing

With Hyperpay, you get speed, security, and scalability—everything your business needs to thrive in the digital economy! 🚀

11. Stripe

Looking for a powerful and flexible payment gateway in the UAE?

Stripe makes it easy for businesses to accept payments and send payouts worldwide. Whether you’re running an e-commerce store, subscription service, marketplace, or in-person retail, Stripe has you covered.

But it doesn’t stop at payments—Stripe helps businesses prevent fraud, send invoices, issue physical and virtual cards, manage finances, and more.

💡 Why Choose Stripe?

✅ Global Payment Processing – Accept payments in multiple currencies

✅ Smart Fraud Prevention – Protect your business with advanced security

✅ Flexible Payment Methods – Cards, wallets, bank transfers & more

✅ Easy Integration – Seamlessly integrate with your website or app

✅ Subscription & Billing Support – Ideal for SaaS and membership-based businesses

💰 Payment Options

💳 Cards – Visa, MasterCard, American Express & more

🏦 Bank Debits & Transfers – Direct payments from customer bank accounts

🛍 Wallets – Apple Pay, Google Pay & regional digital wallets

🔁 Buy Now, Pay Later – Flexible installment options for customers

🔄 Bank Redirects – Simplify payments with bank-linked transactions

💵 Cash-Based Vouchers – Support alternative payment methods

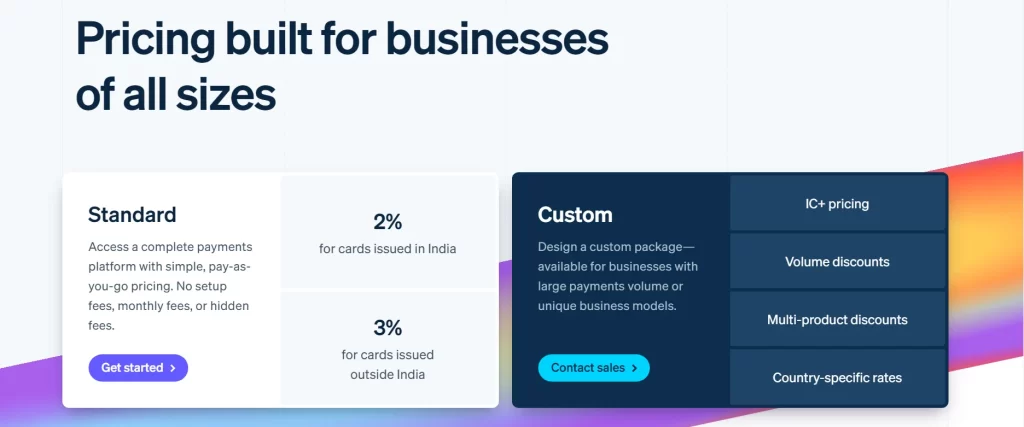

💲 Pricing Structure

⚙️ Integration Options

📄 Hosted Payments Page – A simple, secure checkout page

🎨 Custom Payment Form – Design your own payment experience with Stripe Elements

With Stripe, you get a modern, scalable, and secure payment solution that grows with your business. Start accepting payments today! 🚀

12. Payit

Looking for a fast, secure, and mobile-friendly payment solution?

Payit is revolutionizing the way businesses and individuals handle transactions in the UAE.

Designed for a mobile-first world, it offers seamless, instant payments for everything from bill payments and fund transfers to mobile top-ups—all from your smartphone.

💡 Why Choose Payit?

✅ Mobile-First Convenience – Make payments anytime, anywhere

✅ Secure & Efficient – Advanced security for safe transactions

✅ Real-Time Tracking – Stay updated with instant transaction alerts

✅ Diverse Payment Options – Supports e-wallets, bank transfers & more

✅ Easy Business Integration – Works effortlessly with websites & mobile apps

📲 Supported Platforms

📱 iOS & Android Apps – Fully optimized for mobile payments

🌐 Web-Based Applications – Perfect for e-commerce & online marketplaces

💳 Available Payment Options

💼 E-Wallets – Store funds & make instant payments

🏦 Bank Transfers – Direct transactions from bank accounts

💳 Credit & Debit Cards – Supports Visa, MasterCard & more

🔗 Easy Integration for Businesses

Payit makes it super simple to integrate with your website or mobile app using:

- APIs & SDKs – Seamless technical integration

- E-commerce Plugins – Works with top platforms

Whether you’re an individual looking for a fast and secure way to pay or a business wanting to offer customers a seamless checkout experience, Payit has you covered! 🚀

13. Skrill

Looking for a secure, flexible, and internationally recognized payment platform?

Skrill makes sending, receiving, and managing money easier than ever—whether for personal use or business transactions.

With its global reach and support for multiple currencies, Skrill is a trusted choice for seamless international payments.

💡 Why Choose Skrill?

✅ Trusted Worldwide – Millions of users across the globe

✅ Multi-Currency Support – Ideal for international transactions

✅ Fast & Secure – Industry-leading security for peace of mind

✅ Prepaid Skrill Card – Instant access to your funds anytime

✅ Easy Integration – Works smoothly with websites & mobile apps

🌐 Supported Platforms

💻 Web Applications – Perfect for e-commerce & online businesses

📱 Mobile Apps – Seamless transactions on iOS & Android

💳 Available Payment Options

💼 E-Wallets – Store and transfer money securely

🏦 Bank Transfers – Direct transactions from your bank account

💳 Credit & Debit Cards – Supports Visa, MasterCard & more

💳 Prepaid Skrill Card – Spend funds instantly with a connected card

🔗 Easy Business Integration

Skrill makes it simple for businesses to accept payments via:

- Hosted Payment Pages – Secure, ready-to-use checkout

- APIs for Custom Integration – Seamless setup for websites & apps

Whether you’re a business owner, freelancer, or online shopper, Skrill offers the flexibility, security, and ease-of-use you need for hassle-free global payments. 🚀

14. PayPal

When it comes to online payments, PayPal is a name that stands out.

Whether you’re shopping online, running a business, or sending money to family and friends, PayPal offers a secure, fast, and convenient way to manage transactions.

With its user-friendly interface, global acceptance, and strong security measures, PayPal has become the go-to choice for millions worldwide.

Plus, its ability to link directly to bank accounts and credit cards makes it even more versatile.

🌍 Why Choose PayPal?

✅ Widely Accepted – Trusted by businesses & individuals worldwide

✅ Seamless Integration – Works with top e-commerce platforms

✅ Secure Transactions – Buyer & seller protection for added safety

✅ One Touch Payments – Faster checkouts with saved payment details

✅ Multi-Device Support – Available on web, mobile, & apps

🔗 Integration Options

PayPal offers flexible integration options for businesses:

- APIs & SDKs – Custom integration for seamless payments

- Ready-Made Plugins – Supports WooCommerce, Shopify, Magento & more

- One Touch & PayPal Checkout – Faster, hassle-free transactions

💳 Available Payment Options

💳 Credit & Debit Cards – Supports Visa, MasterCard, and more

🏦 Bank Transfers – Direct payments from your bank account

💼 PayPal Balance – Use funds stored in your PayPal account

⚡ One Touch Payments – Quick & secure checkouts

Whether you’re a small business owner, freelancer, or shopper, PayPal gives you the flexibility and security you need to handle payments effortlessly. 🚀

15. Payoneer

If you’re a freelancer, business owner, or professional working with international clients, Payoneer makes cross-border payments effortless.

With its global reach and user-friendly financial solutions, you can send, receive, and manage funds across multiple countries with ease.

One of Payoneer’s standout features is its virtual bank accounts, allowing users to accept payments in different currencies as if they had a local bank account in that country.

Freelancers can get paid faster, and businesses can handle international transactions seamlessly—all in a secure and compliant environment.

💡 Why Choose Payoneer?

✅ Global Reach – Receive payments from anywhere in the world

✅ Virtual Bank Accounts – Get paid like a local in multiple currencies

✅ Prepaid Mastercard – Use funds for online purchases or ATM withdrawals

✅ Easy Currency Conversion – Convert and transfer funds with competitive rates

✅ Secure & Compliant – Ensuring safe and reliable transactions

🔗 Seamless Business Integration

Payoneer provides easy-to-use integration options for businesses:

- APIs & Plugins – Connect to platforms, websites, and marketplaces

- Direct Bank Transfers – Send and receive funds quickly

- Marketplace Payouts – Ideal for e-commerce sellers and freelancers

💳 Available Payment Options

🏦 Bank Transfers – Receive and send funds effortlessly

💼 E-Wallets – Store and manage your money online

💳 Payoneer Mastercard – Make purchases or withdraw from ATMs

Whether you’re a freelancer looking to get paid faster or a business handling international transactions, Payoneer makes global payments stress-free! 🚀

16. Noon Payments

Noon Payments is transforming online shopping in the Middle East and North Africa (MENA) region by offering secure, fast, and flexible payment solutions.

As the e-commerce industry grows, Noon provides a seamless checkout experience that caters to both businesses and online shoppers.

With a user-friendly interface and multiple payment methods, customers can pay with ease, while businesses enjoy hassle-free transactions.

Whether you’re a retailer, entrepreneur, or a growing online store, Noon Payments makes digital transactions effortless.

💡 Why Choose Noon Payments?

✅ Designed for E-Commerce – Built to support online retail growth

✅ Secure & Fast Transactions – Helping businesses boost conversion rates

✅ Flexible Payment Options – Accepts various payment methods

✅ Seamless Integration – Plugins & APIs for smooth checkout experiences

🔗 Easy Business Integration

Noon Payments offers simple and efficient integration options for e-commerce businesses:

- Plugins for Popular Platforms – Connect with your online store effortlessly

- API Integration – Customize payment flows for a seamless experience

💳 Available Payment Options

💳 Credit & Debit Cards – Visa, Mastercard, and more

💵 Cash on Delivery – Ideal for customers who prefer offline payments

📆 Installment Plans – Flexible payment solutions for big purchases

As e-commerce flourishes in the MENA region, Noon Payments is leading the way by making online transactions smooth, secure, and convenient for everyone! 🚀

Choosing the Right Payment Gateway in Dubai: What You Need to Know

Dubai’s e-commerce industry is booming, and with the government’s push toward a digital economy, online transactions are becoming the norm.

But with so many payment gateways available, how do you choose the right one for your business?

Here are some key factors to consider before making your decision:

🔒 Security First!

You want your customers to feel safe when making payments.

Make sure the payment gateway you choose complies with international security standards like PCI DSS and offers strong fraud protection.

A secure payment process builds trust and keeps your business safe from cyber threats.

🎯 Features That Match Your Needs

Not all payment gateways are the same. Some offer recurring billing, while others focus on one-time transactions.

Make a list of the features your business needs—like multiple payment methods, fraud detection, and seamless checkout—and choose a gateway that checks all the boxes.

💰 Multiple Currencies Matter

Dubai is a global business hub, and if you serve international customers, your payment gateway should support multiple currencies.

No one likes hidden conversion fees, so ensure your customers can pay in their preferred currency without any hassle.

💳 More Payment Options, More Customers

A good payment gateway should accept multiple payment methods—credit and debit cards, digital wallets like Apple Pay and Google Pay, and even local bank transfers.

The more options you provide, the more customers you can cater to!

💸 Watch Out for Fees

Transaction fees, setup fees, monthly charges—payment gateways come with different costs.

Before committing, compare fees from different providers to find a solution that fits your budget.

Sometimes, a slightly higher fee is worth it if the service offers better features and reliability.

🛠️ Easy Integration = Fewer Headaches

Your payment gateway should work seamlessly with your website or e-commerce platform.

Look for providers that offer easy-to-use plugins, APIs, and detailed documentation to make integration smooth and hassle-free.

🇦🇪 Local Currency & Arabic Support

Dubai has a diverse customer base, so your payment gateway should support transactions in AED (UAE Dirhams) to avoid unnecessary currency conversions.

Additionally, Arabic language support makes the payment process easier for a large portion of your audience, improving the overall user experience.

🤝 Integration with Popular Payment Methods

Customers in the UAE prefer different payment options, so your gateway should integrate with:

✅ Credit & Debit Cards – Visa, Mastercard, etc.

✅ Digital Wallets – Apple Pay, Google Pay, Samsung Pay

✅ Local Payment Methods – UAE-based bank transfers and other region-specific options

📜 Compliance with UAE Regulations

The UAE has strict financial regulations, and your payment gateway must comply with the Central Bank’s requirements, VAT laws, and data protection rules.

Choosing a compliant provider helps avoid legal issues and ensures smooth business operations.

📞 Reliable Customer Support is a Must

Technical issues can happen at any time, and a slow response can cost you sales.

Make sure your payment gateway offers 24/7 customer support, quick response times, and knowledgeable assistance when you need it.

Final Thoughts

Choosing the right payment gateway in Dubai isn’t just about convenience—it’s about security, efficiency, and customer satisfaction.

Take your time, compare your options, and pick a gateway that aligns with your business needs. 🚀

Conclusion

This is a list of the best 16 payment gateways in the UAE based on GMI’s research. If you plan to integrate one of these platforms to grow your e-commerce business, we can help.

With more than two decades of expertise in delivering cutting-edge e-commerce solutions, we will assist you in taking your business to the next level.

Frequently Asked Questions

What is a payment gateway and why is it important for my e-commerce website?

A payment gateway is a technology that securely processes payments made by customers on your e-commerce website. It ensures safe transactions by encrypting sensitive information, such as credit card details, and facilitating the transfer of funds between your customer and your business.

How do I choose the best payment gateway for my e-commerce business?

When choosing a payment gateway, consider factors like security features, ease of integration with your website, fees, transaction speed, support for multiple payment methods, and whether it supports international transactions if you’re targeting global customers.

Are payment gateways in the UAE safe to use?

Yes, most payment gateways in the UAE comply with high standards of security, including PCI DSS (Payment Card Industry Data Security Standard), ensuring that your customers’ data is protected during transactions. Always choose a trusted and reputable payment provider to ensure safe transactions.

What are the costs associated with using a payment gateway in 2025?

The cost of using a payment gateway can vary depending on factors such as transaction fees, setup fees, monthly fees, and any additional charges for international transactions. It’s important to compare the fee structures of different gateways to find the most cost-effective solution for your business.

How long does it take to integrate a payment gateway into my e-commerce website?

The time it takes to integrate a payment gateway into your website depends on the platform you’re using and the complexity of the integration. For most e-commerce platforms like Shopify or WooCommerce, the integration can take just a few hours. However, custom-built websites may take longer depending on the specific setup.

Are there payment gateways that support multiple currencies in the UAE?

Yes, several payment gateways in the UAE support multiple currencies, making it easier for international customers to make payments in their preferred currency. This feature is especially important for businesses looking to expand globally.

GMI’s Research Team is a panel of knowledgeable experts from various fields such as digital marketing, social media, and web development, all united by a common goal—to educate. We enjoy exploring everything from the latest industry trends and emerging technologies to people and demographics, both in the UAE and beyond. Through our blog posts, we share valuable insights that help businesses and marketers stay informed and prepared for the challenges and opportunities that lie ahead.